If you’re planning on traveling soon, a travel credit card can be a great way to save money on your trips. Not only can you earn rewards on your purchases, but many travel credit cards also offer benefits like travel insurance, lounge access, and waived foreign transaction fees. However, with so many travel credit cards on the market, it can be difficult to know where to start. Here are some of the best travel credit cards with no fees to help you choose the right one for you.

Top Picks For Best Travel Credit Cards

1. Chase Freedom Unlimited – Best For Everyday Spending

The Chase Freedom Unlimited card offers unlimited 1.5% cash back on all purchases, making it a great option for those who want to earn rewards without worrying about bonus categories. The card also offers a sign-up bonus of $200 after spending $500 in the first three months of opening an account. Additionally, the card has no foreign transaction fees, making it a great choice for international travelers.

Pros

- No annual fee

- Cash back rewards on purchases, including 5% on rotating categories

- Introductory offer of 0% APR on purchases and balance transfers

- Free access to FICO credit score

- Purchase protection and other benefits

Cons

- Rotating categories require tracking to maximize rewards

- Cashback less valuable than travel rewards

- A foreign transaction fee of 3%

- High fees and penalty APR for late payments

- Superb credit needed for high limit & APR

- Balance transfer fee of $5 or 5% applies.

2. Discover it Miles – Best For New Cardholders

The Discover it Miles card offers 1.5 miles per dollar spent on all purchases, and Discover will match all the miles earned at the end of the first year. This effectively means you are earning 3 miles per dollar spent for the first year of card membership. There are no restrictions on how many miles you can earn, and the miles can be redeemed for travel purchases or converted to cash back. The card also has no foreign transaction fees.

Pros

- No annual fee

- Cash back rewards on purchases, including 5% on rotating categories

- Cash back match for the first year

- Free access to FICO credit score

- No foreign transaction fee

- No penalty APR for late payments

- Easy to redeem rewards

Cons

- Rotating categories require tracking to maximize rewards

- Cash back may be less valuable than travel rewards

- Some merchants may not accept Discover

- Balance transfer fee of 3% applies

- Requires good to excellent credit for approval

3. Capital One VentureOne Rewards Credit Card – Best Travel Rewards

The Capital One VentureOne Rewards Credit Card offers 1.25 miles per dollar spent on all purchases, and a sign-up bonus of 20,000 miles after spending $500 in the first three months of opening an account. Miles can be redeemed for travel purchases, and there are no restrictions on how many miles you can earn. The card also has no foreign transaction fees.

Pros

- No annual fee

- Unlimited 1.25x miles on every purchase

- 20,000 bonus miles when you spend $500 in the first 3 months

- No foreign transaction fee

- Miles don’t expire

Cons

- Lower rewards rate compared to other travel cards

- No 0% intro APR for purchases or balance transfers

- Some merchants may not accept the card

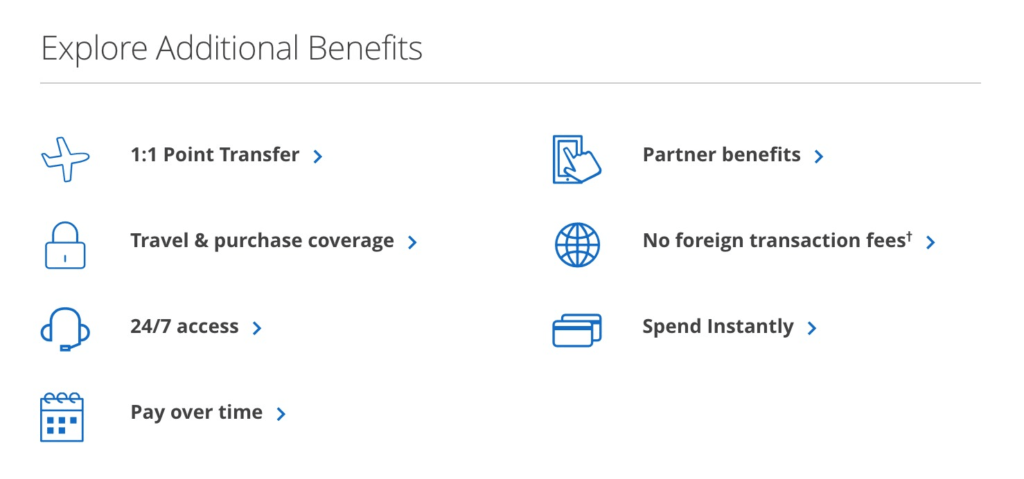

4. Wells Fargo Propel American Express Card – Best For Entertainment and Dining

The Wells Fargo Propel American Express Card offers 3x points on dining, gas stations, rideshares, transit, flights, hotels, homestays, and car rentals, and 1x point on all other purchases. There’s a sign-up bonus of 20,000 points after spending $1,000 in the first three months of opening an account. Points can be redeemed for travel purchases, and the card also offers no foreign transaction fees.

Pros

- No annual fee

- 3x points on dining, gas, travel, and select streaming services

- 0% intro APR for purchases and balance transfers

- No foreign transaction fee

- Cell phone protection

Cons

- Points can only be redeemed for travel, cash back, or gift cards

- 3% balance transfer fee

- Requires good to excellent credit for approval

5. Citi Double Cash Card – Best For Cash Back

The Citi Double Cash Card offers 1% cash back on all purchases, and an additional 1% cash back when you pay for those purchases, effectively giving you 2% cash back on everything. There are no restrictions on how much cash back you can earn, and the cashback can be redeemed for statement credits, direct deposits, or checks. The card also has no foreign transaction fees.

Pros

- No annual fee

- 2% cash back on all purchases (1% when you buy, 1% when you pay)

- 0% intro APR for balance transfers for 18 months

- No limit on cashback earnings

- Free access to FICO credit score

Cons

- No sign-up bonus

- No 0% intro APR for purchases

- 3% foreign transaction fee

- Late payment can result in penalty APR

Best Overall – Chase Sapphire Preferred Card

For the best overall travel credit card with no fees, the Chase Sapphire Preferred Card deserves a nod as it’s a highly recommended option for those looking to earn valuable rewards for travel while enjoying valuable travel benefits without an annual fee.

The Chase Sapphire Preferred Card offers a generous sign-up bonus, where new cardholders can earn 80,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. These points can be redeemed for $1,250 in travel through the Chase Ultimate Rewards program.

In addition to the sign-up bonus, the Chase Sapphire Preferred Card earns 2X points on travel and dining purchases worldwide, and 1X point on all other purchases. The points can be transferred to various airline and hotel loyalty programs at a 1:1 ratio, allowing for flexibility in travel redemption options.

Cardholders also receive valuable travel benefits, such as trip cancellation/interruption insurance, baggage delay insurance, and primary car rental insurance. Plus, there are no foreign transaction fees, making it an ideal card for international travel.

Tips for Maximizing Your Travel Credit Card:

- Use your card for all your purchases:

- The more you use your card, the more rewards you’ll earn. Try to use your card for all your purchases, and pay off the balance in full each month to avoid interest charges.

- Take advantage of sign-up bonuses:

- Many travel credit cards offer sign-up bonuses for new cardholders. Make sure to meet the spending requirements within the specified time period to earn the bonus.

- Pay attention to bonus categories:

- Some travel credit cards offer bonus rewards in specific categories, such as dining or travel. Make sure to use your card for purchases in these categories to maximize your rewards.

- Use your rewards wisely:

- Make sure to redeem your rewards for travel purchases, as this is where you’ll get the most value. Many travel credit cards also offer additional benefits such as travel insurance or airport lounge access, so make sure to take advantage of these perks as well.

- Consider using multiple cards:

- Depending on your spending habits and travel goals, it may be beneficial to use multiple travel credit cards to maximize your rewards. For example, you may use one card for dining and entertainment purchases, and another for flights and hotels.

- Keep an eye on annual fees:

- While the travel credit cards listed above do not have annual fees, some travel credit cards may charge an annual fee. Make sure to weigh the benefits of the card against the annual fee to determine if it’s worth it for you.

Conclusion

In summary, a travel credit card can be a great way to save money on your travels, and the cards listed above offer great rewards and benefits without any annual fees. By using your card for your purchases, taking advantage of sign-up bonuses and bonus categories, and using your rewards wisely, you can make the most of your travel credit card and save money on your trips.